Insights / Research / Netflix breaks subs record with live sports boost & ad tier increase

Research / 22nd January 2025

Netflix kicked off the earnings report season yesterday by leapfrogging Wall Street’s forecast and adding close to 19 million new subscribers.

This figure, its largest quarterly gain, was more than double analyst predictions of a 9.8 million rise. The streaming service now reaches 301.6 million accounts worldwide.

That does not include extra members who view via password sharing. Netflix estimates that around 700 million individuals worldwide have access to its service.

Coupled with 16% revenue growth YOY and an operating income passing the $10bn mark, the results paint a positive picture for the streamer.

Delving beyond the report, Digital i has dived into the data to shed further light on the viewers that led to the streamer’s success.

The addition of ad-supported tiers, and their lower price point, has been widely adopted by streamers as a new way to increase both revenue and subscription numbers.

Netflix said that in Q4 2024 membership on its ad plans grew nearly 30% quarter over quarter.

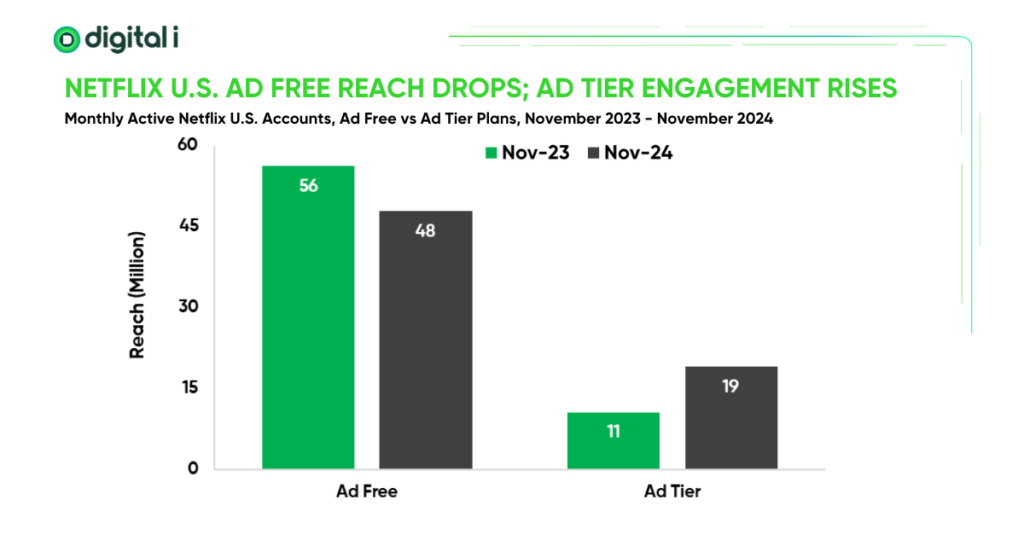

Digital i research bears out the increased use of ad tiers. The number of monthly active Netflix U.S. ad tier accounts rising from 11 million to 19 million between November 2023 and November 2024. We also saw a drop in monthly active users on ad free plans from 56 million to 48 million in that period.

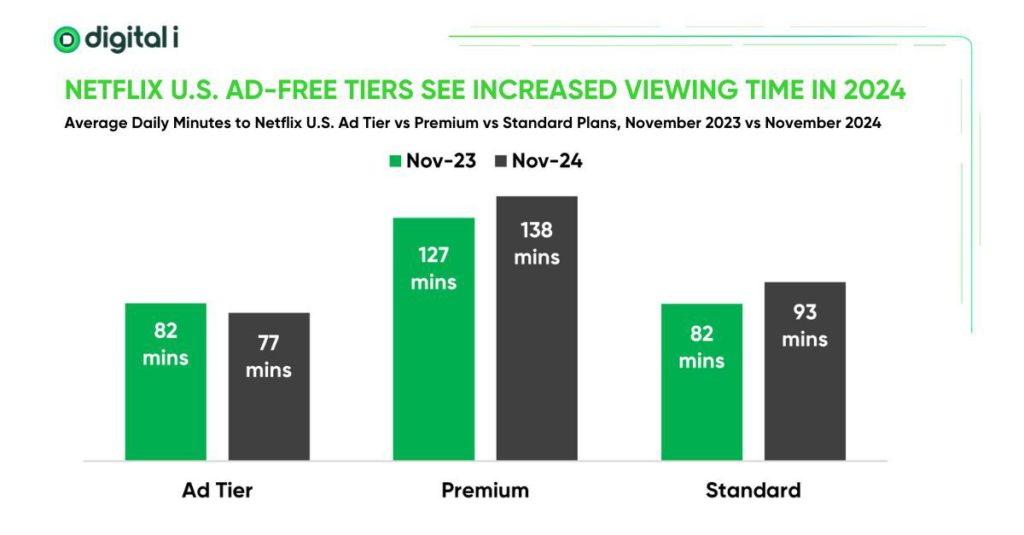

However, while the ad tier adoption rate rises, the average amount of time spent by those same Netflix U.S. ad tier users decreased by five minutes between those dates.

According to our data, during the same 12-month period, the average daily usage by Netflix U.S. premium and standard tier accounts went up by 11 minutes. This is no mean feat in the crowded and competitive U.S. streaming market.

In its letter to shareholders, Netflix credited its Q4 slate, specifically stand-out titles such as the Jake Paul vs. Mike Tyson fight, two live NFL games and the return of Korean drama Squid Game, with driving high engagement.

No surprises that the boxing match drew a lot of attention, but Digital i data paints a more revealing picture of its U.S. performance, with 56% of the country’s subscribers streaming the event. This made it Netflix’s most impactful release in Q4.

The live sports push is clearly generating results for Netflix, at least on its home turf, with 27% of U.S. subscribers tuning in to cheer on their teams. But it’s not just the viewership that’s important to note, but where these viewers came from.

Digital i estimates that around 9-10% of the NFL audience were new subscribers, with the sport driving a portion of those new sign-ups over the holiday period.

Live sport was not the only competition drawing in viewers to Netflix during Q4, with the long-awaited return of Squid Game on 26 December.

It had been three years since the release of season one, and anticipation was high for this sophomore instalment. The show was quickly catapulted to sixth place when measured by Digital i for Q4 audience reach, with 27% of U.S. viewers watching within just the first four days of launch.

Netflix revealed yesterday that Squid Game season 2 is on track to become one of its most-watched original series seasons.

On the film front, the Taron Egerton-led thriller Carry-On was the title with the highest U.S. audience reach, with 43% of subscribers watching in the first 17 days of release, according to Digital i data. Netflix told shareholders that the title had joined its all-time Top 10 films list.

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research