Insights / Company News / Digital i announces ad-supported measurement during Ad Week

Company News / 10th October 2024

Advertising Week has arrived in New York, and ad-supported programming is top of mind with entertainment and tech executives—and not just in Manhattan.

Global streaming video platforms are among those with dollar signs in their eyes. 2024 has seen the prioritization of an important industry profit driver: ad-supported programming. Therefore, understanding subscriber engagement and demographic profiles is paramount to realizing the commercial potential in this space.

For this reason, by year end, Digital i will empower clients with enhanced streaming data. These new data points will reveal the demographic breakdowns and engagement of ad-supported subscribers across four major global streaming platforms.

To preview what this data will look like, download our Streaming Trends Report. Below we’ve highlighted some key insight around ad-supported programming in the domestic market.

Amazon began 2024 by initiating a mass roll-out of their ad-supported plan, giving them a head start on turning their subscribers into advertising revenue. In fact, this move established the biggest ad-supported premium SVOD subscriber base in the U.S., and none of their competitors has been able to catch up. Digital i estimates the following breakdown of subscription plans for the major global streamers.

Though Netflix has the smallest proportion of its subscriber base opting to watch ads, it remains the most-watched streamer in the U.S. and worldwide.

However, there is a large gap between viewing generated by subscribers who watch ads and those who do not. As mentioned in IndieWire, Netflix ad-free subscribers in the U.S. watch 40% more than ad-supported. Nonetheless, Netflix U.S. ad-supported subscribers watch an average of 94 minutes of content on the platform each day.

For Disney+, Max, and Prime Video, the distinction between streaming habits of ad-supported and ad-free subscribers is less pronounced. For example, in the first half of 2024, daily viewing time was about the same for both sets of users at the three major streamers.

As streaming platforms tighten their focus on profitability, the need for engagement analysis around ad-supported programming will expand in strategic significance. For this reason, moving into 2025, Digital i aims to be a central source for this critical information.

Download our Streaming Trends Report to read data-driven consumer insights on the future of SVOD.

DIGITAL-I.COM

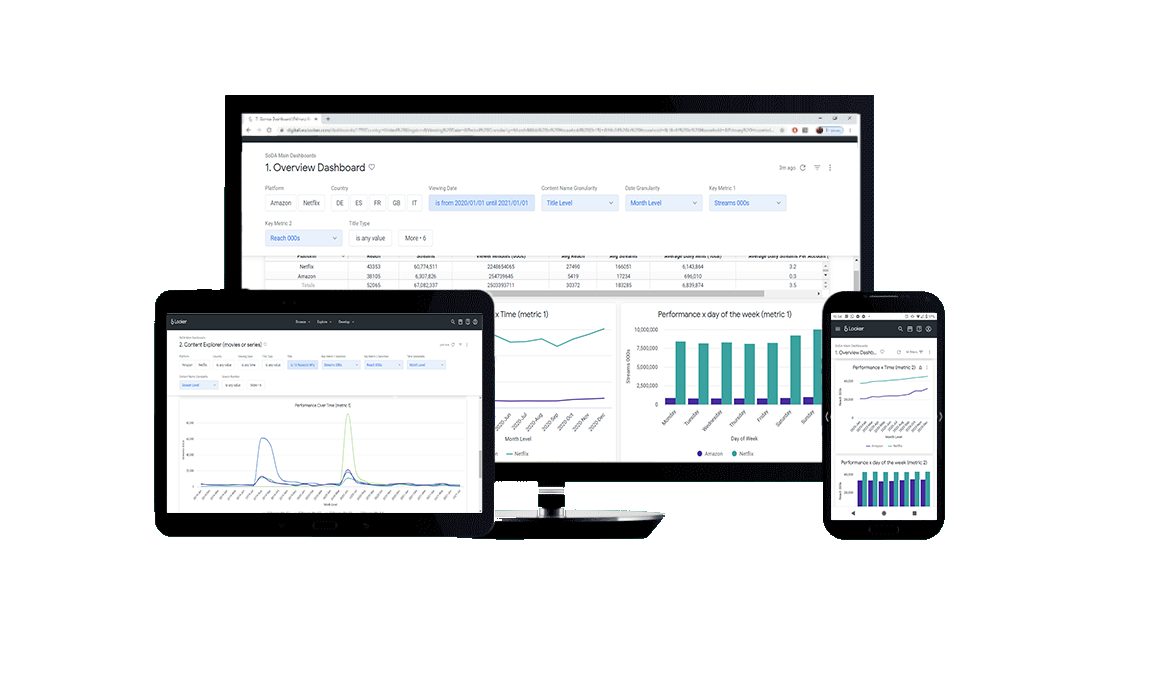

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research