Insights / Industry / Crime and Romance: Netflix Top 10s of Q3’24

Industry / 22nd October 2024

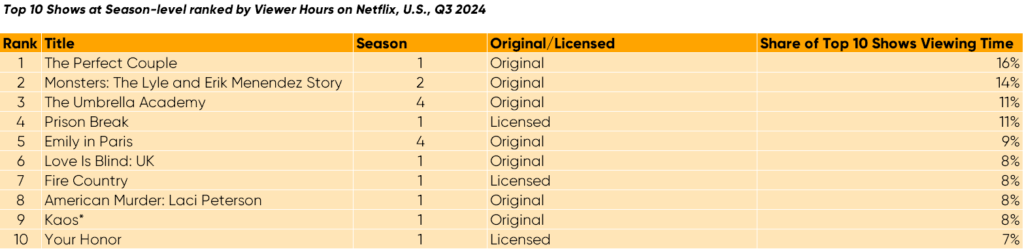

The search for Merritt’s killer was everyone’s summer obsession. So, it’s no surprise that the Netflix original show The Perfect Couple was the most-watched Q3’24 show among American platform users.

In the race to increase profitable streaming operations, the past several years has seen a rise in viewership of licensed content. However, that doesn’t mean big-budget in-house programming isn’t getting made.

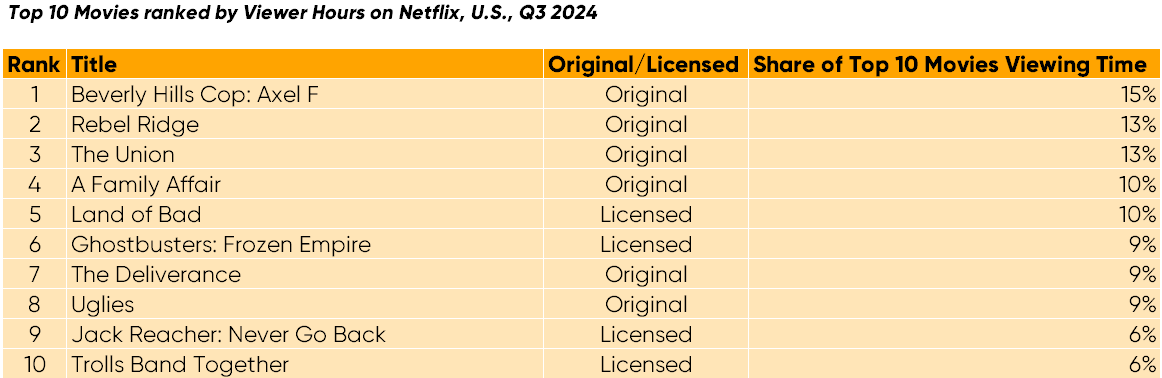

Among Netflix U.S.’s top 10s for Q3’24, 6 films and 8 series are Netflix Originals. These charts also tracked a steady popularity of unscripted programming. In the U.S., the most-viewed shows of the quarter feature true crime and reality alongside licensed content produced by competitors.

After a positive quarterly earnings announcement, in which Netflix announced a 15% YoY increase in revenue and 5 million subscribers, understanding the content that drives their status as market-leader is an important element of streaming strategy.

Source: Digital i viewing estimates based on actual account data from a representative sample of U.S. streaming homes. *Netflix announced that Kaos would not be renewed for a second season in early October.

Netflix is doubling down on real life stories, both harrowing and hilarious. As mentioned in an article featuring our data in the Business Insider, true crime documentaries and scripted shows based on true crime stories lead the ratings. Hits like Monsters: The Lyle and Erik Menendez Story and American Murders all feature in the top 10s. Balancing out the shock and intrigue is reality programming like Love is Blind. The UK version launched in Q3 and quickly climbed up the charts.

Typically, the production costs for unscripted productions are significantly smaller than for their scripted counterparts. For this reason, investing in unscripted Original content comes at a lower risk for major players like Netflix. Kaos, a British mythological black comedy made for Netflix by Charlie Covell featured in the top 10 shows of Q3 2024 for both the U.S. and Europe. Nonetheless, Netflix announced early October that the show would not return for a second season.

Digital i data shows that 40% of U.S. Netflix subscribers who started watching Kaos finished the entire season.

Licensed shows also made the Top 10, namely Prison Break, Your Honor and Fire Country. These two off-air network programs are owned by Netflix competitors Disney and Paramount Global, respectively.

For library content, the advantages of the “Netflix accelerator effect” surpass the case for walled content gardens. For this reason, Netflix competitors continue to relax policies regarding licensing content to the platform.

Nonetheless, while licensing to Netflix is now commonplace for catalogue assets, few major streamers license their original content to the market-leader.

That’s most likely due to the high value of original and exclusive content when it comes to subscriber acquisition.

Source: Digital i viewing estimates based on actual account data from a representative sample of U.S. streaming homes.

The 4 licensed movies in the Top 10s all had theatrical release before moving to Netflix, reflecting a trend toward showing more films after premiering at the box office. Action movies Land of Bad, Ghostbusters: Frozen Empire, and Jack Reacher: Never Go Back joined kid flick Trolls Band Together in the top performers.

The drive to widen profit margins is expanding at Netflix and throughout the industry. At one time, success was measured mostly by growth in original programming. However, these days the platform is increasingly reliant on licensing deals for increasing revenue streams. And now the competitive landscape is evolving. Competitor studios and streamers are growing partnerships with the platform to distribute their programs, achieving high viewership ratings with the deals.

Viewing data is integral to achieving profitable streaming operations. Digital i provides high quality data alongside strategic analysis.

Stay informed of key consumer insights both in the U.S. and around the world.

DIGITAL-I.COM

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research