Insights / News and Opinion / Netflix elevates non-English language content to the global stage

News and Opinion / 18th January 2021

Over the past ten years, Netflix’s rise to world domination has sparked a revolution in the world of entertainment. And it hasn’t only done this with American content, it has invested across the globe in non-English language content too.

TV used to be an industry flush with money, broadcaster’s executives would jetset around the world and stay at top hotels for conferences and networking purposes. The advertising money was coming in and showed no sign of stopping as more and more people became hooked on the Big TV events of large reality shows, live sport and thrilling local dramas.

Now, the world is abuzz with the latest global content events.

That’s right, Netflix has expanded their remit to a large proportion of the globe, meaning that what used to be national TV events have become global content events. Stranger Things, Money Heist, The Witcher and now The Queen’s Gambit. The latter has recently been credited with an increased interest in chess around the world! Nevertheless, people haven’t suddenly found more hours in their day for entertainment, their attention has been redirected meaning that linear TV no longer scores the big wins that it did before.

Image by Andrés Rodríguez from Pixabay

This has spread doubt, uncertainty and even ire among national broadcasters as they watched a giant American company start to steal away a significant proportion of their younger viewers’ screen-time.

British broadcasters have long expressed their worries about the so-called ‘Americanisation’ of content if people move from the traditional linear TV format toward the Netflix streaming model.

Alex Mahon, CEO of Channel 4, when asked about these streaming services said ‘‘They’re certainly not interested in British originated content that serves the interest of all Britons, not in growing the range of production companies in the UK that offer jobs and creative opportunities in all corners of the country. What possible incentive is there for a Silicon Valley giant to encourage production in Northern Ireland, in Scotland or the North-east of England?’’, and further went on to talk about how US news feeds were ‘‘more concerned about profit than trust or accuracy.’’

While it’s true that the majority of Netflix’s most popular content was made in the USA, another trend has started to manifest… Let’s return to the four big-name titles I mentioned at the beginning of this blog. Stranger Things, Money Heist, The Witcher and The Queen’s Gambit. Granted, the majority of these productions are American, but one of them is a Spanish production and another is based on a series of Polish novels.

When was the last time that a Spanish production or a series based on the books by a Polish writer became big in a single country (outside of Spain and Poland), let alone across the world?

Since 2018, Non-English language content on Netflix has been steadily growing in popularity. In 2018, there were only 2 shows or films in French, German or Spanish that had a reach of over 5 million people. In 2019, that figure increased to 7, rising to 8 in 2020.

Netflix’s investment in local content as a strategy to increase global subscriber numbers does more than simply appeal to a new market. It opens the door to a world of content that falls outside a viewer’s language, culture and custom. It blurs borders for content.

Spanish language content on Netflix has delivered exceptional results in the Spanish speaking world, as well as in the UK, US, France, Germany, Italy and Spain. The conclusion is undeniable -people are willing to engage with shows despite not necessarily speaking the language.

The table above shows us the top performing non-English language content on Netflix in UK FIGS. It is evident that Spanish and German language content performs exceptionally well amongst the foreign languages, taking up 8 places in the top 10. Being the 2nd most spoken language in Europe, it is no surprise to see Germany on the list. However, France is the 3rd most spoken language in Europe, and does not feature on this list at all.

This would suggest that people are not just choosing to view content in languages they speak, but are actually choosing to watch content filmed in a language they do not understand. Netflix’s excellent subtitling and dubbing technology must also receive credit for this…

Of course, none of this is a reason to advocate a sort of neoliberal model of global content. Alex Mahon and other British broadcasters were right in saying that Netflix will never be able to replace the role of PSBs (public service broadcasters).

Reflecting all the sides of a society through factual and drama, as well as reporting diligently on current affairs within a country are of utmost importance. There’s no doubt about it. So, perhaps it would not be too far a leap to say that seeing factual programmes, films and dramas that reflect the thoughts, ideas and identities of societies across the world can only be a good thing for the creativity, cohesion and imagination of the global viewer.

During a time when leaving your house is hard let alone your country, it is a blessing that content is able to travel so freely across the world and it would be a simplification to say that Netflix only promotes the viewing of American content. As far as we can tell, it is a global platform that is just as capable of encouraging a South Korean family to watch The Queen’s Gambit as it is of suggesting that a North American bachelor watch #Alive.

Netflix has democratised content and changed the status of non-English language content from the exclusive forray of language students, arthouse cinema goers and BBC4 viewers, to anyone who has a Netflix account and is feeling adventurous.

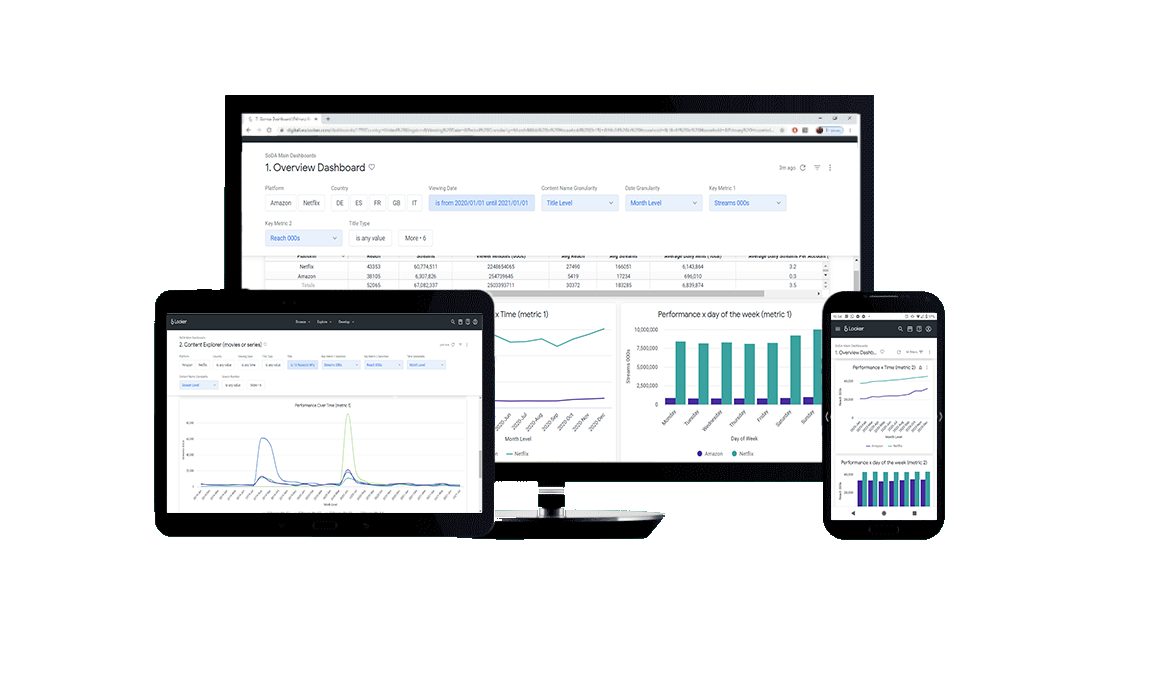

To find out about how your content or streaming platform can optimise its performance, value and global potential, get in touch here to request a free demo of SoDA, our exclusive platform of Netflix and Amazon Prime viewing data information.

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research