Insights / News and Opinion / The State of Streaming in 2024

News and Opinion / 11th January 2024

The streaming boom is well and truly over.

Multiple outlets are hailing the end of the streaming wars. Content budgets are being slashed as Wall Street sours on the SVOD business model. It’s tempting to turn away from the consolidating market to look for the Next Big Thing (e.g. FAST, CTV, bundles).

But that’s where you’d be making a mistake.

Because 2024 is the year of the rise of a new star in the streaming world: data. And it’s by sourcing high-quality data and deep-dive analysis that the fragmented media market will start to become whole again.

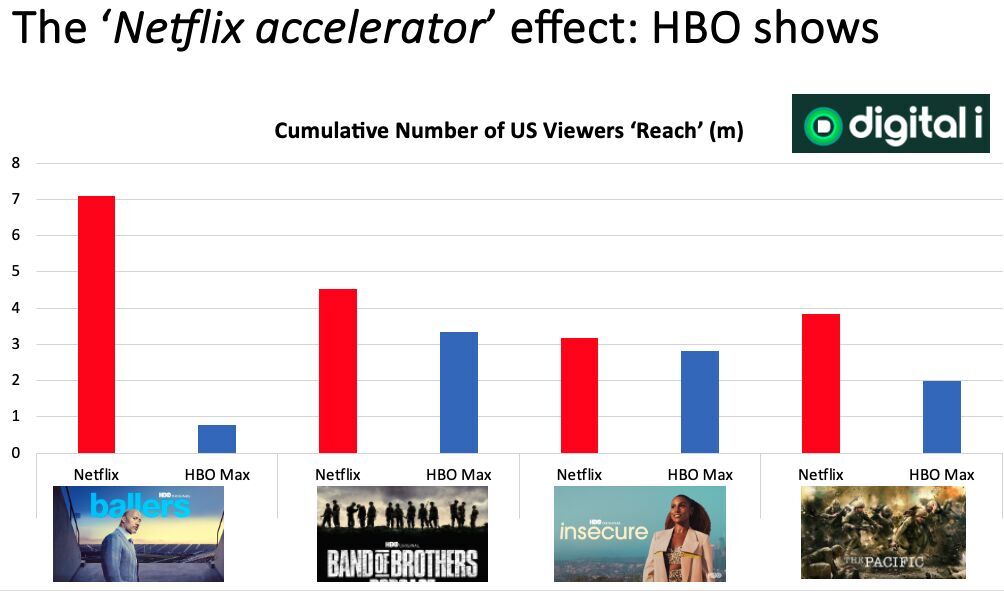

As the SVOD industry pushes for profitability, our industry advisor, Ben Keen, tapped into the dismantling of ‘walled gardens’ of content using Digital i’s in-house global, harmonised SVOD viewership data. Through seeing how HBO shows reached larger audiences once they moved from Max to Netflix in the USA, Ben identifies the force behind the Suits phenomenon and gives it a name: the Netflix accelerator effect. To see his analysis in full, click here.

For investors, the financials of major global streaming businesses have failed to prove that there is a big enough market for all the players to have a profitable slice of the pie. For this reason, the one-size fits all SVOD model is no longer fit for purpose. Each streamer needs to evaluate their content slate, their target viewerbase and alternate models to straight DTC.

Ben’s insight showcases how streamers can benefit from windowing their content on larger competitor platforms. A hybrid model of content sales and SVOD could help streamers off-set costs and generate more revenue from existing and new content.

But how can you know what content will benefit from the Netflix accelerator effect? And what if less exclusivity with content leads to a loss of subscribers in the long-term?

To achieve a balanced and informed view on the effects of selling top-shelf content to competitor streaming platforms, it’s important to understand the following:

How do viewer segments travel between platforms and what content pulls them away?

Which content drives subscriptions from platform-to-platform?

What is the retention value of certain shows?

How to calculate the potential value of your show to a market-leading platform.

The right data can empower leaders to make these hard decisions. Some streamers will become more niche. Others will rely more heavily on ad-revenue. However, with the right valuation and categorisation of content slates and viewer types: the perfect balance can be struck.

Global SVOD ratings empower content sales teams to take data-driven conclusions to their stakeholders. That way they can maximise the distribution value of their content slates with the approval of the C-suite through demonstrating the value of knocking down walled gardens of exclusive content.

Alternatively, a thorough analysis of historical, harmonised viewership data can assist content strategy teams in understanding how different types of content travel across regional and linguistic barriers. By learning more about how global content trends vary country-to-country you can ensure your promotional strategies maximise the chance of launching a global hit.

Now’s the time for the brightest creatives to align with the sharpest data analysts and forge a new path towards a sustainable streaming ecosystem.

One thing’s certain: you can’t do that without good-quality data.

Are you ready to meet the 2024 star of the streaming world?

Join the viewing revolution.

Ask us about our data.

Speak to an expert to find out how our intelligence platform will revolutionise your TV reporting & SVOD research